My role

Product and design lead

The working team

Up's COO and relevant SMEs from Bendigo Bank, technical lead and ~6 other engineers, product design, brand and marketing teams

Project duration

About 2 years

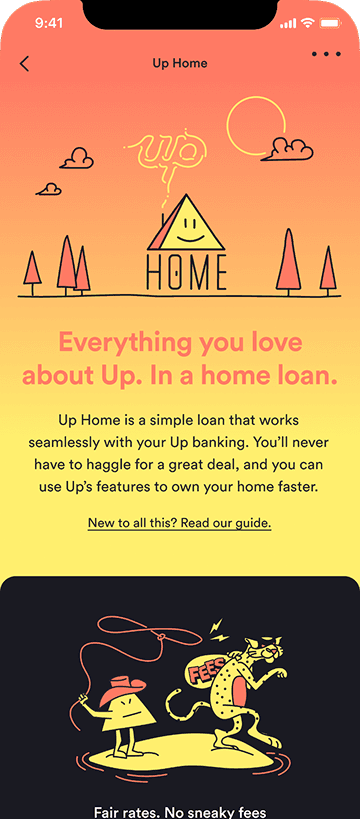

In December of 2020, Up decided it wanted to offer a home loan product as part of their revenue strategy. The aim was to offer an in-app application and servicing experience, just as Up customers were used to.

No one working on Up knew how the home loans process worked on the bank side. Since I’d previously worked on banker tools for home loans at NAB and had some tiny insight into the process, I put my hand up to lead the design for this product.

To this day I find it hard to believe that such a small team pulled this together and successfully signed up Up’s first home loan customers.

Discovery

Although Up is known for reinventing the banking experience for customers, in the financial industry there are many processes that are more or less defined by regulatory compliance.

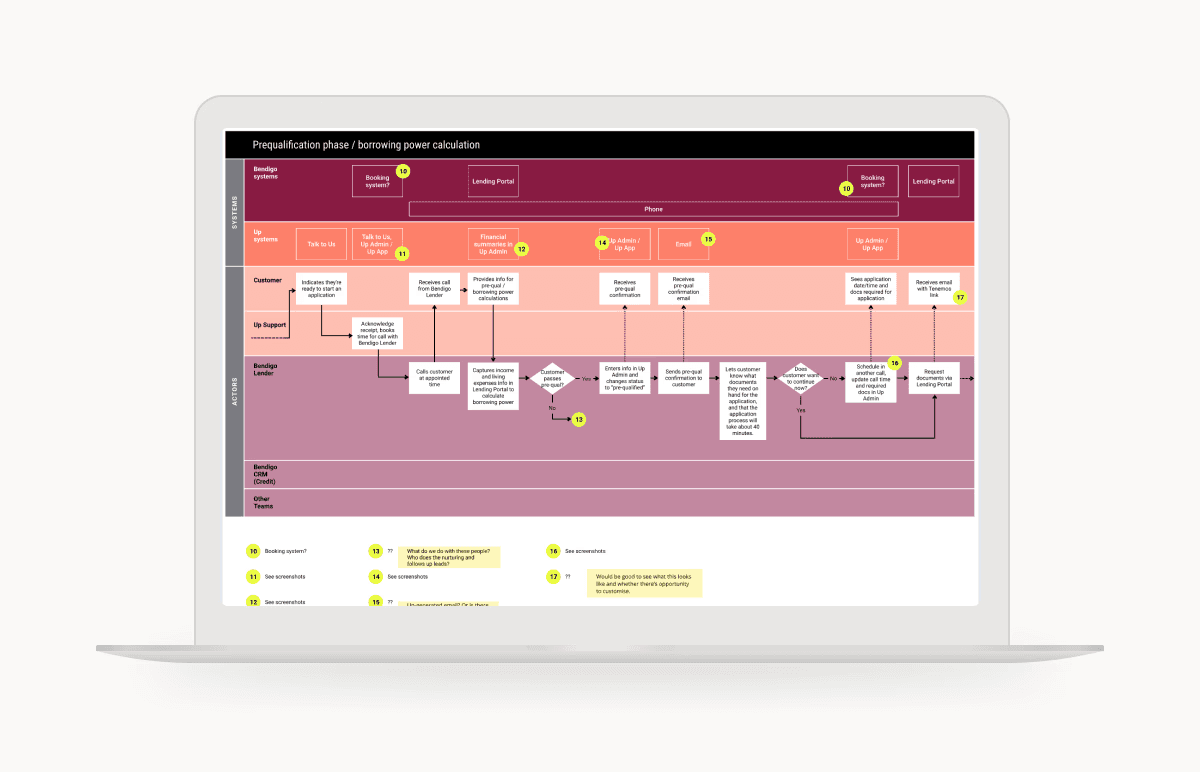

In order to understand what we could change, we needed to understand the home loan process from end to end, from entry points through application assessments to settlement and servicing.

Bendigo Bank has always provided the core financial systems for Up, so our home loan product would have to fit their business processes in the backend.

There were a lot of gaps in my knowledge of the process, and it seemed that there wasn’t one single person who knew everything end to end on the Bendigo side either, so mapping the whole process out ended up taking several months or research.

Product vision

Although the ideal state for Up Home was to allow customers to do everything in the app, it was clear that we weren’t going to be able to replace the entire Bendigo process for MVP.

As I learned enough about various parts of the process, I started marking potential ways that we could bring the experience through to the Up app (or website), so that we could start thinking about how various integrations and handovers, whether they’re technical or human, might work.

UX design

The users involved in this process were not just the customers, but all the different parties involved throughout the journey, for example:

the online application team at Tiimely (then TicToc);

the team that produces contracts and other paperwork;

external vendors who supply printed statements;

the lending and financial assistance teams at Bendigo;

lending assessment teams;

the customer-facing lending support team.

Our internal interfaces needed to support all this behind the scenes, while keeping it simple for the customers.

For each touchpoint in the business process that I had marked for Up, I designed wireframes for both internal and customer users.

Delivery

UI design

With support from the branding designers and the head of design, I fleshed out the in-app experience. I oversaw the build and reviewed work from the engineering team, and liaised with the marketing and legal teams to finalise copy.

Logic design

I built spreadsheets for key calculations like repayment figures, stamp duty, key fact sheet information as reference for our engineers to ensure business-based rules and formulas were correctly translated into code.

I was also responsible for overseeing the Up content that was to be housed on the Tiimely platform which handled the application data capture.

Release and outcomes

We knew that this was a big, complex feature to put out to customers, and had planned to release it in stages to targeted customers.

I worked with the COO (who was in charge of overseeing the Up home loan banking product) to design an in-app Expression of Interest survey to determine suitable segments for different stages of the release.

After an initial release with selected family and friends beta testers, we gradually widened the audience from early access customers to the whole customer base within a few months, and hit our home loan settlement targets in the following financial year.